The Intersection of Business Valuation and Corporate Finance

In the world of business, the relationship between business valuation and corporate finance is crucial to understanding a company’s financial health, investment potential, and overall strategic direction. Business valuation provides the numerical foundation for key financial decisions, while corporate finance encompasses the strategies and activities designed to optimize a company’s financial performance. Together, they form the cornerstone of decision-making processes in mergers and acquisitions (M&A), investment analysis, capital structuring, and other pivotal corporate strategies.

In this blog, we will delve into how business valuation and corporate finance intersect and influence each other, with real-world examples to illustrate the concepts.

Understanding Business Valuation

At its core, business valuation is the process of determining the economic value of a business or company. There are various methods used to determine a company’s value, such as:

- Income-Based Approach: This method values a business based on its projected future cash flows, discounted to the present value.

- Market-Based Approach: This method compares a company to similar businesses in the market to estimate its value.

- Asset-Based Approach: This method calculates a company’s value based on its assets minus liabilities, focusing on tangible resources.

These valuation methods provide critical insights into the company’s worth, which can be used for a range of strategic decisions.

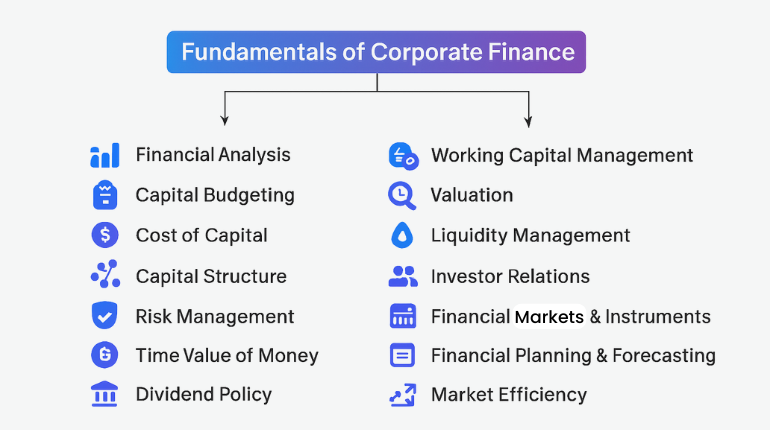

Understanding Corporate Finance

Corporate finance refers to the financial activities and strategies that companies use to maximize shareholder value. This includes decisions related to:

- Capital Structure: The mix of debt and equity used to finance a company’s operations and growth.

- Capital Budgeting: The process of evaluating and selecting investment projects that will increase the company’s value.

- Risk Management: The techniques and strategies employed to minimize financial risk while maximizing returns.

- Dividend Policy: Decisions regarding how profits are allocated between reinvestment in the business and shareholder distributions.

Corporate finance decisions are interwoven with business valuation, as the financial strategies adopted by a company will ultimately influence its valuation.

The Intersection of Business Valuation and Corporate Finance

1. Investment Decisions:

When a company evaluates potential investments, its business valuation plays a significant role in determining whether or not the investment is worthwhile. Valuations help quantify the expected return on investment (ROI) and assess whether the investment aligns with the company’s long-term goals.

Example: A Real Estate Development Firm

Imagine a real estate development company considering whether to invest in a new commercial property. The company would first perform a business valuation to determine the expected cash flows from leasing the property and compare that to the investment required. If the valuation indicates a positive return on investment (ROI) based on projected cash flows, it would justify the investment. The company might also assess the cost of capital, a key concept in corporate finance, to determine the appropriate mix of debt and equity financing for the project.

2. Mergers and Acquisitions (M&A):

In M&A transactions, the process of business valuation is critical to determining the fair price of a target company. Corporate finance strategies are often shaped around the insights provided by the valuation. For example, an acquirer may need to structure the deal using a combination of debt financing and equity in a way that maintains financial stability and maximizes value post-acquisition.

Example: The Acquisition of WhatsApp by Facebook

In 2014, Facebook acquired WhatsApp for $19 billion. Business valuation played a key role in determining the company’s worth, even though WhatsApp was not yet generating significant revenue at the time. Facebook’s corporate finance team would have evaluated synergies (the expected benefits of combining the two companies), projected future earnings potential, and assessed the impact on its capital structure. Facebook used a combination of stock and cash to finance the acquisition, a decision driven by its strategic goals and corporate finance objectives.

3. Capital Structure Decisions:

A company’s capital structure—the balance of debt and equity—directly impacts its valuation. The right mix of debt and equity allows a company to minimize its cost of capital, which in turn increases the present value of its future cash flows. Valuation models, such as the Weighted Average Cost of Capital (WACC), incorporate the capital structure to assess how financing decisions influence a company’s value.

Example: Apple’s Capital Structure Strategy

Consider Apple Inc., which historically has maintained a relatively low debt level compared to its equity. By managing its capital structure in this way, Apple has been able to keep its cost of capital low, positively influencing its valuation. Furthermore, Apple has used its high cash reserves to fund innovation and strategic acquisitions, thus boosting its growth prospects and, in turn, increasing its market valuation.

4. Risk Management and Valuation Sensitivity:

Risk management is another area where corporate finance and business valuation intersect. When valuing a business, analysts must account for various risks that could impact the company’s future earnings, including market risks, credit risks, and operational risks. These risks are incorporated into valuation models through discount rates and sensitivity analysis.

Example: Discount Rate Adjustment in Risky Markets

For instance, a company operating in a volatile emerging market would face higher political and economic risks. To account for these risks, the discount rate used in the company’s valuation would be higher, reducing its present value and reflecting the added uncertainty. Corporate finance strategies in such markets might involve hedging or diversifying to mitigate these risks.

5. Dividend Policy and Valuation:

Dividend policy is another area where corporate finance intersects with business valuation. A company’s decision to pay dividends affects its valuation in two ways. First, the size and sustainability of dividend payouts impact the company’s cash flow projections. Second, the decision signals to investors about the company’s financial health and growth prospects.

Example: The Impact of Dividend Policy on Valuation

A high dividend payout might suggest to investors that a company is in a strong financial position, which could increase its valuation. Conversely, a company that retains earnings for reinvestment in high-growth projects may appeal to growth investors, who are focused on long-term value appreciation rather than immediate cash returns. Companies like Microsoft have shifted from paying minimal dividends to increasing payouts as their business matured, affecting both investor sentiment and market valuation.

6. Capital Budgeting and Valuation Synergies:

Capital budgeting refers to the process of evaluating potential investment projects. When making these decisions, corporate finance professionals rely heavily on valuation techniques to assess the profitability of projects, calculate expected cash flows, and determine the appropriate investment structure.

Example: Evaluating a New Product Line

A manufacturing company considering the launch of a new product line would use business valuation to estimate future revenues, costs, and profit margins. This helps determine whether the new product will add value to the company. Corporate finance strategies, such as determining the net present value (NPV) of the project or using internal rate of return (IRR), allow the company to evaluate the investment’s potential impact on its valuation and ensure that it is aligned with shareholder interests.

How Business Valuation Influences Corporate Finance Strategy

The relationship between business valuation and corporate finance is reciprocal. Business valuation influences corporate finance decisions in the following ways:

- Determining Cost of Capital: The valuation of a company’s equity and debt determines the cost of capital, which is a critical input in capital budgeting and other financial strategies.

- Setting Acquisition and Investment Goals: Accurate valuations are key to setting clear financial goals and assessing the feasibility of corporate finance strategies such as acquisitions, partnerships, and capital investments.

- Guiding Dividend and Capital Structure Decisions: Valuation provides insights into a company’s financial health, helping corporate finance professionals determine the appropriate dividend policy and capital structure for maximizing shareholder value.

The Role of Outsourcing in Business Valuation and Corporate Finance

Outsourcing can offer businesses significant advantages when it comes to the intricacies of business valuation and corporate finance. By partnering with a specialized Knowledge Process Outsourcing (KPO) firm like Synpact Consulting, companies can tap into expert-level support, gain cost efficiency, and scale operations seamlessly – ensuring that financial strategies are optimized for success.

A KPO firm brings in-depth knowledge of valuation methodologies, financial modeling, and strategic decision-making, offering your business access to specialized expertise that may not be available in-house. This can be especially crucial when dealing with complex valuations, mergers and acquisitions, or capital structure decisions. By outsourcing these critical functions, your business gains the ability to make more informed and data-driven financial decisions without the burden of hiring and training a specialized team internally. Additionally, outsourcing provides the scalability necessary to adjust resources based on business needs. Whether you’re looking to manage seasonal fluctuations, execute large-scale financial projects, or respond to market changes, a KPO partner can quickly scale services to match. This ensures that your business remains agile and responsive while maintaining the high standards required for financial success.

For businesses seeking to optimize their financial processes, outsourcing to a trusted KPO firm offers a strategic advantage in today’s competitive marketplace.

Key Takeaways

- Business valuation provides the foundation for making informed financial decisions, directly influencing corporate finance strategies.

- Investment decisions are guided by business valuation to assess potential returns and align with long-term company goals.

- Mergers and acquisitions rely on business valuation to determine fair pricing and optimize deal structures.

- Capital structure decisions are influenced by business valuation, affecting a company’s cost of capital and overall value.

- Risk management strategies incorporate valuation to adjust for market, credit, and operational risks that affect future earnings.

- Dividend policy decisions are shaped by business valuation, impacting investor perception and company valuation.

- Valuation sensitivity analysis accounts for risk factors and adjusts financial models to reflect uncertainty.

- Corporate finance uses capital budgeting and valuation models, like NPV and IRR, to evaluate the profitability of new projects.

- Companies must balance dividends and reinvestment strategies based on valuation insights to maximize shareholder value.

- The relationship between business valuation and corporate finance is reciprocal, with each influencing the other for strategic financial growth.