The Role of Professional Valuation Standards and Certifications in Business Valuation

In the realm of business valuation, achieving an accurate and credible assessment of a company’s worth is crucial for decision-making processes such as mergers and acquisitions, financial reporting, litigation, tax planning, and investment analysis. However, a key challenge in business valuation lies in the subjectivity and potential for inconsistency in the valuation process. To address this, the adoption of professional valuation standards and certifications plays an essential role in ensuring that business valuations are reliable, transparent, and grounded in recognized methodologies. Professional valuation standards and certifications play a crucial role in ensuring the accuracy, consistency, and credibility of valuation practices across various industries. In today’s complex business environment, where the need for reliable and transparent valuation of assets and businesses is paramount, adherence to established standards and obtaining relevant certifications is essential for practitioners in the valuation field.

In this blog, we will explore the importance of professional valuation standards and certifications, delve into the various frameworks and organizations that set these standards, and illustrate with examples how these practices enhance the credibility and accuracy of business valuations.

Understanding Professional Valuation Standards and Certifications

Professional valuation standards refer to a set of guidelines and principles that establish the procedures, methodologies, and ethical practices that business valuators must follow. These standards ensure that the valuation process is conducted in a consistent, transparent, and objective manner, regardless of the industry or asset class being valued.

In the absence of a universal approach, valuation standards provide a framework for valuators to work within, reducing the risk of biased or inconsistent valuations. These standards also provide a benchmark for stakeholders to assess the quality and integrity of a business valuation report.

Certifications serve as badges of honor in the valuation world, showing that professionals have met certain education and experience requirements, and adhere to ethical standards.

Importance of Professional Valuation Standards

- Credibility and Consistency: Valuations must be credible, especially when they are used for significant financial or legal decisions. Adherence to professional standards ensures that the valuation is carried out using recognized methods, making the results more consistent and defensible in the face of scrutiny.

- Transparency: Professional standards require valuators to disclose the assumptions, methodologies, and data used in their analysis. This transparency enables stakeholders, such as investors or courts, to understand the basis of the valuation and evaluate the appropriateness of the methods used.

- Legal and Regulatory Compliance: In many jurisdictions, professional valuation standards are a legal requirement. Following established standards helps ensure that valuations comply with relevant regulations, minimizing the risk of legal disputes or penalties.

- Ethical Conduct: Professional standards include codes of ethics that govern how valuators conduct their work. This includes maintaining objectivity, avoiding conflicts of interest, and ensuring confidentiality. These ethical guidelines help preserve the integrity of the valuation process.

Leading Professional Valuation Standards

Several organizations around the world have developed specific standards and guidelines to regulate the business valuation process. These standards not only enhance the reliability of the valuation but also help to standardize practices across the industry.

International Valuation Standards (IVS):

The International Valuation Standards Council (IVSC) issues the International Valuation Standards (IVS), which are globally recognized guidelines used by valuation professionals across various asset classes. IVS is essential in promoting consistency and comparability in valuations, especially for cross-border transactions.

Uniform Standards of Professional Appraisal Practice (USPAP):

In the United States, USPAP, developed by the Appraisal Standards Board (ASB), sets the rules and procedures for appraisers and valuators. These standards govern the valuation of real estate, personal property, and business assets, ensuring that valuations are credible, ethical, and legally compliant.

International Financial Reporting Standards (IFRS) & Generally Accepted Accounting Principles (GAAP):

While not specifically designed for business valuations, IFRS and GAAP play a significant role in the financial reporting and accounting aspects of valuation. For businesses that are publicly traded or preparing financial statements, compliance with IFRS or GAAP ensures that asset values, including goodwill, intellectual property, and fixed assets, are reported consistently and in accordance with global accounting standards.

Royal Institution of Chartered Surveyors (RICS) Valuation – Global Standards:

The RICS Valuation – Global Standards, also known as the Red Book, is a globally recognized set of standards for property valuation, including business and intangible asset valuation. This standard provides a framework for valuing businesses in the real estate sector, especially when properties form a major part of a company’s asset base.

Certified Valuation Analyst (CVA) & Accredited Senior Appraiser (ASA) Certifications:

Certifications from respected organizations like the National Association of Certified Valuators and Analysts (NACVA) and the American Society of Appraisers (ASA) offer a way to demonstrate expertise and commitment to professional standards. Professionals who hold certifications like the CVA or ASA are trained in business valuation methodologies and are expected to adhere to rigorous ethical guidelines.

Role of Valuation Certifications in Business Valuation

Certifications act as a mark of credibility for business valuators, signaling to clients, investors, and other stakeholders that the professional has met stringent educational, experience, and ethical requirements. Certification also involves ongoing education, ensuring that the valuator is up to date with the latest developments in valuation theory and practice.

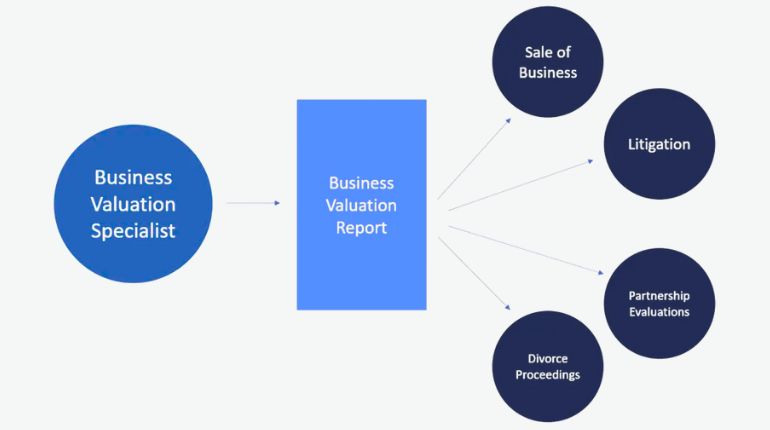

Example: A company preparing for a sale may choose to hire a certified Accredited in Business Valuation (ABV) professional, whose certification ensures that they have specialized expertise in determining the value of businesses. This provides added confidence to both the seller and the buyer that the valuation process is sound, impartial, and in line with industry standards.

Conclusion

Professional valuation standards and certifications play a vital role in ensuring that business valuations are accurate, credible, and legally defensible. By adhering to internationally recognized standards like the IVS, USPAP, and RICS, business valuators can provide consistent, transparent, and reliable valuations, fostering trust among stakeholders.

For businesses engaged in mergers, acquisitions, taxation, financial reporting, or litigation, working with certified valuation professionals and adhering to professional standards is critical in ensuring that business valuation processes are conducted with the highest level of integrity and expertise. Whether you’re preparing for a strategic sale, a financial statement review, or resolving a legal dispute, understanding and leveraging these valuation standards can be the key to successful, objective, and well-supported business valuation outcomes.

How Outsourcing Business Valuation to a Professional Firm Can Benefit Your Business

- Cost Efficiency: Maintaining an in-house valuation team requires significant resources, including staffing, training, and software investments. By outsourcing, businesses can access top-tier valuation services without the associated overhead costs. As a result, you only pay for the services you need, when you need them. This can be particularly valuable for companies that require valuations infrequently but still want to ensure high-quality results.

- Expert Support: Outsourcing business valuation to professionals ensures access to seasoned experts who specialize in valuation methodologies, industry trends, and legal compliance. These professionals are adept at handling complex valuations, whether it’s for mergers and acquisitions, intellectual property, or financial reporting. Their in-depth knowledge ensures that the valuations are objective, credible, and tailored to meet your unique business needs.

- Scalability: For growing businesses or those involved in multiple transactions, outsourcing allows for scalability. A professional valuation firm can handle high-volume or complex valuation requirements, providing the flexibility to meet fluctuating demands. Whether your business needs periodic valuations or requires ongoing support, outsourcing ensures that you have the resources to scale your valuation process accordingly.

At our KPO firm Synpact Consulting, we specialize in providing outsourced business valuation services that adhere to international standards and certifications, helping clients navigate complex valuation scenarios with ease. By outsourcing to our team of experts, your business can enjoy cost-effective, high-quality, and scalable solutions tailored to your specific needs, allowing you to focus on core business operations while we handle your valuation requirements with precision and professionalism.