Understanding the Impact of Economic cycle on Business Valuations

In the world of finance, understanding how economic cycles influence business valuations is critical for both investors and business owners. Whether you’re a startup seeking investment or an established company exploring a merger or acquisition, the prevailing economic cycle plays a pivotal role in determining your company’s value. Economic cycles impact financial performance, growth rates, and investment climate, which in turn affects valuation metrics such as Price-to-Earnings (P/E) ratios, EBITDA multiples, and discounted cash flow (DCF) models.

What is an Economic Cycle?

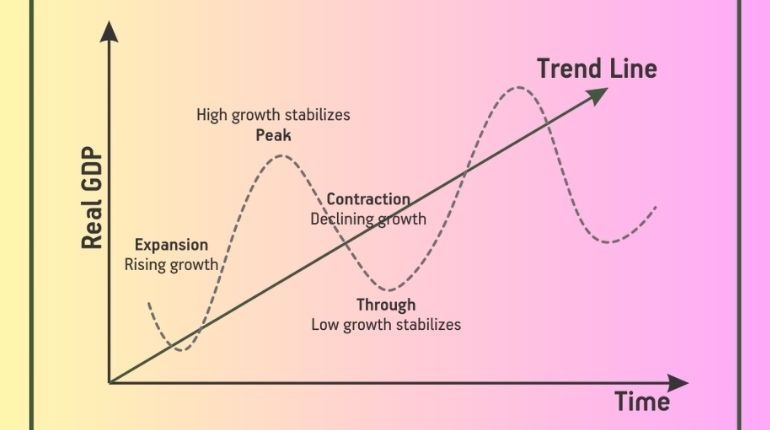

An economic cycle, also known as the business cycle, refers to the fluctuations in economic activity that occur over time in an economy. These cycles are typically characterized by four main phases:

- Expansion: A period of growth where economic activity increases, leading to higher employment, higher income, and higher business activity.

- Peak: The point at which the economy reaches its highest point of activity before beginning to slow down.

- Recession: A decline in economic activity, marked by a reduction in consumer spending, business investments, and higher unemployment.

- Recovery: The phase where the economy begins to bounce back from a recession, gradually moving toward expansion.

How Do Economic Cycles Impact Business Valuations?

Business valuations involve determining the economic value of a business using several financial metrics and valuation techniques. Valuation methodologies like Price-to-Earnings (P/E) ratio, Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), and Discounted Cash Flow (DCF) models are all influenced by the prevailing economic cycle.

Let’s take a closer look at how each phase of the economic cycle influences business valuations:

1. Expansion Phase: High Growth and Optimism

In periods of expansion, businesses tend to thrive. Consumer confidence rises, and demand for goods and services increases. As a result, businesses see higher revenues and profits, which directly influence their valuation. The increased optimism surrounding growth prospects, coupled with a stronger market presence, often leads to higher multiples when applying valuation methods like the Price-to-Earnings (P/E) ratio or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

For example, in the late 1990s, technology companies such as Amazon and eBay saw tremendous growth during the dot-com boom, which led to massive valuations. Investors were optimistic about future earnings, driving up the value of tech stocks and businesses operating in related industries.

The lesson? During an expansion, business owners and investors should expect higher valuations, but caution must be exercised to avoid overvaluing a business based on overly optimistic growth projections.

2. Peak Phase: Stability but Increased Risks

At the peak of an economic cycle, business valuations are often at their highest. Market conditions are favorable, with strong consumer demand, robust business performance, and relatively low interest rates. However, valuations during this phase can be misleading. A peak is often followed by a slowdown or recession, and businesses may be valued based on inflated expectations of continued growth.

Take the example of the housing bubble in the mid-2000s. Many real estate companies were valued based on unrealistic future growth expectations, and the market was characterized by a high demand for housing. When the bubble burst in 2007-2008, the resulting collapse in home prices led to significant reductions in the valuation of real estate companies.

The lesson? Investors should be wary of buying or valuing businesses at their peak, as the risk of overpaying for assets increases, especially if market conditions begin to shift toward a downturn.

3. Contraction Phase: Decline in Valuations

Recessions are challenging times for business valuations. During economic downturns, demand for goods and services typically declines, leading to lower revenues and profits. Businesses may experience cash flow issues, rising debt levels, and reduced consumer confidence, which can all negatively impact their valuation.

Take, for example, the 2008 financial crisis. During this period, many businesses, especially in the financial and real estate sectors, saw their valuations plummet as a result of reduced consumer spending, credit tightening, and a general decline in economic activity. Companies that were once highly valued were now faced with bankruptcy, mergers, or significant reductions in their worth.

The lesson? For businesses undergoing valuation during a recession, it’s essential to factor in the risks of economic contraction. A conservative approach to projections and future cash flow assumptions can help create more realistic valuations.

4. Trough Phase: Recovery and Optimism for Growth

In the recovery phase, economies gradually start to grow again, and businesses begin to show signs of improvement. As demand for goods and services picks up, companies may benefit from increased revenues and profit margins. However, recovery valuations can be volatile, as businesses attempt to bounce back from the losses of the recession, and investors are cautious about future performance.

A good example of this can be seen in the recovery of the automotive industry post-2008. Companies like General Motors and Chrysler faced severe financial difficulties during the recession, but as the economy began to recover, their valuations slowly rebounded, aided by government bailouts and increasing consumer confidence.

The lesson? Business owners and investors should closely monitor macroeconomic indicators during recovery. While valuations may start to rise, the path to full recovery can be slow, and certain sectors may take longer to rebound than others.

Why Understanding the Economic Cycle is Crucial for Business Valuations

As a finance professional, it’s vital to understand the cyclical nature of business performance and valuations. The stage of the economic cycle can help you:

- Anticipate Market Trends: By recognizing where the economy is in the cycle, you can predict trends in demand, cost structures, and investor sentiment, which directly influence valuations.

- Adjust Valuation Models: During different phases of the economic cycle, adjustments need to be made to valuation models. For instance, during expansion, a higher growth rate assumption may be appropriate, while during contraction, a more conservative approach may be needed.

- Risk Management: Understanding the economic cycle allows valuation professionals to incorporate risk factors into their models and assess the potential downside of investments, particularly during recessions.

Industry-Specific Impact of Economic Cycles on Valuations

While the economic cycle affects all businesses, its impact can vary significantly depending on the industry. For example:

1. Technology Industry- During Expansion, tech companies benefit from high demand, innovation, and investor optimism, leading to higher valuations. During Contraction, essential tech services remain resilient, but startups and non-essential tech face reduced valuations due to cautious investment.

2. Retail Industry- During Expansion, increased consumer confidence and spending lead to higher sales and valuations, especially for strong brands. During Contraction, discretionary goods see reduced demand, lowering valuations, though essential and discount retailers may maintain stability.

3. Real Estate Industry- During Expansion, low-interest rates and increased demand for residential/commercial properties push valuations higher. During a contraction, recessions lead to lower demand, higher borrowing costs, and decreased property values, especially in commercial real estate.

4. Healthcare Industry- During Expansion, growing demand for healthcare services and R&D funding boosts valuations, especially in pharmaceuticals and hospitals. During Contraction, while more resilient, elective procedures see demand declines, affecting valuations in certain healthcare segments.

5. Energy Industry- During Expansion, higher global demand for energy (oil, gas, renewables) increases revenue and company valuations. During Contraction, lower energy demand during recessions reduces valuations, though renewable energy companies may remain more stable.

The Role of Outsourcing in Enhancing Business Valuations

In the complex landscape of business valuations, outsourcing plays a crucial role in helping businesses manage costs, access expert support, and scale operations effectively. For businesses involved in economic analysis and valuations, outsourcing can provide access to specialized knowledge and resources without the overhead costs of in-house teams. A Knowledge Process Outsourcing (KPO) firm like Synpact Consulting can offer highly skilled financial analysts and valuation experts who are proficient in handling advanced valuation models such as P/E ratios, EBITDA, and DCF analyses.

By partnering with a KPO firm, businesses can gain access to cutting-edge industry research, in-depth data analytics, and customized financial models tailored to specific market conditions. Outsourcing not only enhances the quality of valuations but also ensures that these assessments reflect the most accurate and up-to-date economic data, which is critical when economic cycles fluctuate.

Furthermore, outsourcing provides flexibility and scalability, allowing businesses to adjust resources according to market conditions without long-term commitments. This means companies can handle fluctuating demand for valuations during periods of economic expansion, contraction, or recovery – enabling faster, more accurate decision-making with reduced risk. By leveraging outsourced expertise, businesses can optimize their valuations while maintaining a lean and efficient operational structure.

Key Takeaways

- Economic Cycles Influence Business Valuations: Economic cycles – expansion, peak, contraction, and trough – directly affect business performance and valuation, as they influence factors like demand, consumer confidence, and investment climate.

- Expansion Boosts Valuations: During economic growth, businesses experience higher demand, increased profits, and higher investor confidence, leading to increased valuations, especially in growth-driven industries.

- Recessions Cause Valuation Declines: Economic downturns lead to reduced consumer spending, lower demand, and more cautious investing, causing valuations to decrease, particularly in discretionary sectors.

- Industry Sensitivity Varies: Different industries respond to economic cycles in unique ways. Tech, healthcare, and renewable energy sectors may be more resilient during recessions, while real estate and retail face steeper declines.

- Tech Industry’s Volatility: The tech industry sees rapid valuation increases during expansions, driven by innovation and investor optimism, but is vulnerable to funding cuts and market corrections in downturns.

- Retail’s Dependence on Consumer Confidence: Retailers, especially those in discretionary sectors, face significant valuation declines in recessions due to reduced consumer spending. Essential retailers may be less impacted.

- Real Estate Cycles Impact Property Values: Real estate valuations are highly sensitive to interest rates and economic conditions, with property values and rental incomes suffering during recessions, especially in commercial sectors.

- Healthcare’s Resilience with Caveats: Healthcare companies are relatively insulated during downturns, but elective procedures can see reduced demand, affecting valuations in certain segments like private healthcare providers.

- Energy Sector’s Sensitivity to Demand: The energy sector, particularly oil and gas, is cyclical, with valuations rising during expansions due to increased demand and falling during recessions due to reduced consumption and lower prices.

Adapting Valuations to Industry-Specific Conditions: Understanding how each industry reacts to economic cycles is crucial for accurate business valuations, as each sector faces different challenges and opportunities during various economic phases.