Understanding the Weighted Average Cost of Capital (WACC) in Valuation: A Deep Dive

In the world of business valuation, determining the correct cost of capital is a pivotal factor. One of the most commonly used metrics to assess this is the Weighted Average Cost of Capital (WACC). WACC serves as a fundamental building block for valuing businesses, especially when using discounted cash flow (DCF) models to estimate a company’s intrinsic value.

Understanding how WACC is calculated and how it affects a company’s valuation is crucial for making sound investment decisions, setting business strategies, and conducting accurate financial assessments.

What is WACC?

At its core, WACC represents the average rate of return a company is expected to pay to finance its operations through a combination of debt and equity. This weighted average takes into account the cost of each capital component – debt, equity, and sometimes preferred stock—while giving weight to their respective proportions in the company’s capital structure.

In simpler terms, WACC answers the question: What is the minimum return that a company needs to generate to satisfy both its debt holders and equity investors?

Formula for WACC

The formula for WACC is as follows:

WACC= (MVe / MVv × Re) + (MVd × Rd × (1 − Tc))

Where:

- MVe = Market value of equity

- MVd = Market value of debt

- MVv = Total market value of the company (Equity + Debt)

- Re = Cost of equity

- Rd = Cost of debt

- Tc = Corporate tax rate

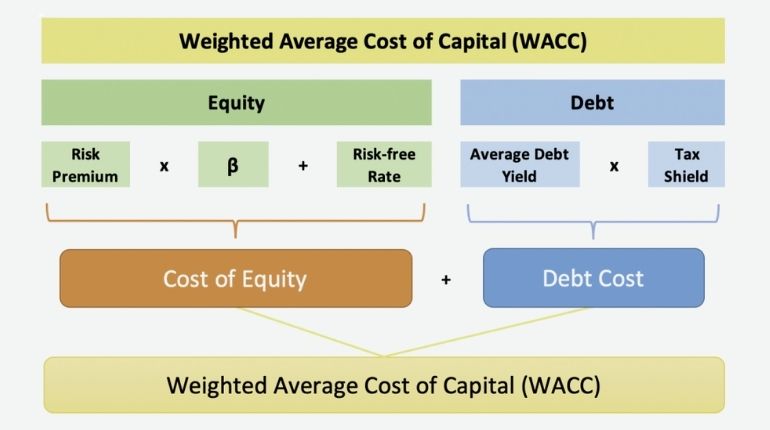

Breaking Down the Components of WACC

1. Cost of Equity (Re):

The cost of equity is the return that shareholders expect from their investment in the company. It reflects the risk of the company’s equity in comparison to the market. It can be calculated using the Capital Asset Pricing Model (CAPM):

Re = Rf + β × (Rm – Rf) × Re

Where:

- Rf = Risk-free rate (typically the return on government bonds)

- β = Beta (a measure of the company’s risk in relation to the market)

- Rm = Expected market return

2. Cost of Debt (Rd):

The cost of debt is the effective rate that a company pays on its borrowed funds. This rate typically comes from interest payments on loans or bonds issued by the company. Unlike equity, interest expenses on debt are tax-deductible, which is why the cost of debt is multiplied by (1 – Tc) to account for the tax shield.

3. Capital Structure Weights (E/V and D/V):

These components represent the proportion of equity and debt in the company’s overall capital structure. By dividing the market value of equity (E) and debt (D) by the total value (V), we obtain their respective weights in the company’s financing.

4. Tax Shield (Tc):

The corporate tax rate (Tc) plays a role in reducing the effective cost of debt since interest payments on debt are tax-deductible. This results in a lower overall cost of capital when debt is used in the capital structure

Why WACC is Important in Business Valuation?

WACC is essential for valuing businesses because it is used as the discount rate in Discounted Cash Flow (DCF) models, which help determine the present value of future cash flows. A higher WACC suggests a higher risk for the business, and therefore, it reduces the present value of future cash flows. Conversely, a lower WACC indicates a lower risk and increases the present value of those cash flows.0

For example, if the WACC of a company is 10%, the company must earn at least 10% on its capital investments to satisfy both debt holders and equity investors. If it fails to meet this benchmark, the company will likely struggle to generate sufficient returns to maintain its operations or attract further investment.

Example of WACC in Action

Let’s walk through an example to better understand how WACC is calculated and how it influences business valuation.

Example: Company X has the following financial data:

- Market value of equity (E): ₹500 million

- Market value of debt (D): ₹300 million

- Cost of equity (Re): 12%

- Cost of debt (Rd): 6%

- Corporate tax rate (Tc): 30%

The total market value of the company (V) is the sum of equity and debt:

V= E + D = 500 million + 300 million = 800 million

Now, let’s plug these values into the WACC formula:

| WACC = (500/800 × 12%) + (300/800 × 6% × (1-0.30)) |

| WACC = 0.625 × 12% + 0.375 × 6% × 0.70 |

| WACC = 7.5% + 1.575% = 9.075% |

Impact of WACC on Business Decisions

WACC is not just a theoretical number; it has real-world implications for business strategy and decision-making. A company with a high WACC might reconsider its capital structure, opt for cheaper debt financing, or take steps to improve its risk profile to lower its cost of equity. On the other hand, businesses with lower WACC values can confidently pursue growth opportunities, knowing they can secure financing at relatively lower costs.

WACC is also critical when evaluating potential investments or mergers and acquisitions. A company seeking to acquire another business must compare the WACC of both companies to determine whether the investment will create value. If the target company’s WACC is higher, the acquirer will need to adjust the terms of the deal to account for the increased risk.

Drawbacks of WACC

WACC is a valuable tool for business valuation, but there are situations where it may not be the best option. It can be challenging to use when a company has a complex or irregular capital structure, such as non-traditional financing methods like convertible securities or hybrid instruments. It also becomes tricky when a company’s debt-to-equity ratio fluctuates, or if the company operates in a highly volatile market, as WACC assumes a steady mix of debt and equity. In these cases, the model may not accurately reflect the company’s true cost of capital or the risks involved.

Additionally, WACC is sensitive to the assumptions used to calculate it, such as the risk-free rate and the company’s beta. A small mistake in estimating these values can lead to inaccurate results. In businesses facing financial difficulties or in industries with rapidly changing conditions, WACC may not fully capture the risks, leading to over-optimistic valuations. In such cases, alternative methods or adjustments are needed to get a clearer picture of a company’s real cost of capital and financial health.

How Outsourcing Can Benefit Businesses in WACC Calculation and Valuation

In the complex world of financial analysis, calculating and understanding WACC requires precision, expertise, and significant resources. This is where outsourcing can provide substantial benefits, especially when working with a Knowledge Process Outsourcing (KPO) firm specializing in finance and valuation services like Synpact Consulting.

By outsourcing WACC calculations and financial assessments to an experienced KPO firm, businesses can access a pool of financial experts who are skilled in handling intricate models like Discounted Cash Flow (DCF) and Capital Asset Pricing Model (CAPM). This allows companies to avoid the burden of recruiting and training in-house experts, leading to significant cost efficiencies.

Moreover, outsourcing provides scalability, allowing businesses to adjust their capacity depending on project needs, whether it’s for a one-time valuation or ongoing financial monitoring. KPO firms bring not only technical expertise but also a keen understanding of industry-specific nuances that can impact WACC, ensuring more accurate and reliable results.

By leveraging outsourced support, businesses can focus on strategic decision-making and growth while having confidence that their financial evaluations are in the hands of skilled professionals. This integration of expert support and cost-effectiveness can ultimately drive smarter investments, better capital allocation, and long-term success.

Key Takeaways

- WACC represents the average rate of return a company must pay to finance its operations through debt and equity, weighted by their respective proportions in the capital structure.

- The formula for WACC incorporates the cost of equity, cost of debt, and the company’s capital structure, adjusting for the tax benefits of debt.

- Cost of equity is the return expected by shareholders, calculated using models like the Capital Asset Pricing Model (CAPM), which considers risk-free rate, market return, and the company’s beta.

- The cost of debt is the effective interest rate a company pays on its borrowed funds, adjusted for tax savings since interest payments are deductible.

- WACC gives different weights to debt and equity based on their market values, reflecting their relative share in the company’s financing.

- The corporate tax rate reduces the cost of debt since interest payments on debt are tax-deductible, thus lowering the overall WACC.

- WACC is used as the discount rate in discounted cash flow (DCF) models, affecting the present value of a company’s future cash flows and its valuation.

- A higher WACC suggests higher business risk, reducing the present value of future cash flows, while a lower WACC indicates lower risk and higher valuations.

- In the example provided, a company with ₹500 million in equity and ₹300 million in debt had a WACC of 9.075%, guiding investment and financing decisions.

- Companies use WACC to optimize their capital structure, evaluate investments, and make informed financial decisions to create shareholder value.